This page presents the (T)LTRO-Tracker.

1. Introduction

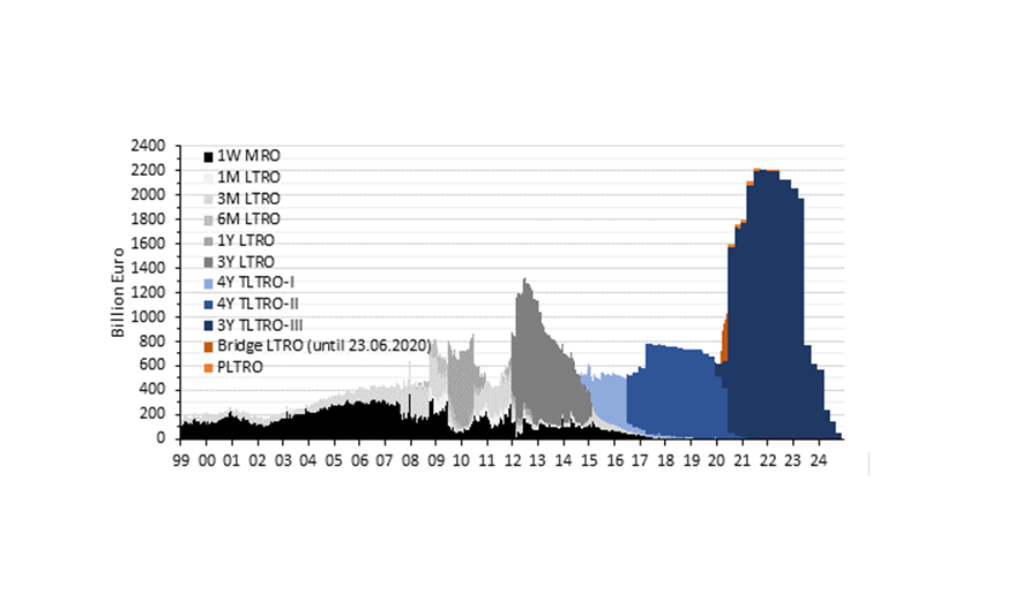

The (T)LTRO-Tracker gives an insight into the scale and duration of the Eurosystem refinancing operations. Strongly rising refinancing requests of banks can be an indicator of financial stress on the private funding market of banks.

3. Explanation

The (T)LTRO-Tracker shows all outstanding refinancing operations of the Eurosystem. Vice versa, it reflects all refinancing requests of euro area banks with the Eurosystem. Originally, the refinancing operations consisted of the one week main refinancing operation (1W MRO) and the three month longer-term refinancing operation (3M LTRO), which were alloted in a competitive auction.

During the financial crisis from 2008 onwards the Eurosystem switched to a tender procedure with fixed-rate full allotment liquidity provision: all refinancing requests of euro area banks are fulfilled if the collateral requirements are met. The two existing refinancing operations were supplemented by various longer-term refinancing operations (1M, 6M, 1Y & 3Y LTROs). As private funding markets froze these large-scale central bank lending programs (LTROs) helped to avert a collapse of the financial system. The TLTRO programs, initiated in 2014, offer longer-term funding at accommodative terms, if banks subsequently hand out credits to households and enterprises. The borrowing rate for banks in the TLTRO-I program was equal to the main financing rate (by then 0.05%) plus 10 basis points, which in 2015 was adjusted to the main financing rate (by then 0.05%) plus 0 basis points. In the TLTRO-II program the interest rate was changed to the rate of the deposit facility, which equaled -0.4% by then. In the TLTRO-III program banks can access funds as low as -1% (deposit facility rate -0.5% minus 50 basis points), if the ECB’s lending performance criterion is met. On 07.04.2020, the collateral requirements to participate in the refinancing operations were eased.

In 2020 and 2021 the refinancing requests of banks grew strongly due to the COVID-19 shock. Currently (29.09.2021) all refinancing operations amount to €2210 billion, having increased by €1579 billion since January 2020. On 24.06.2020, €389 billion of the Bridge LTRO and €371 billion TLTRO-II were rolled over into the TLTRO-III. With already €216 billion of TLTRO-III outstanding there was a net expansion of €548 billion. In the offerings of TLTRO-III.5 (24.09.2020), TLTRO.III.6 (10.12.2020), TLTRO.III.7 (18.3.2021), TLTRO.III.8 (17.06.2021), TLTRO.III.9 (29.09.2021) and TLTRO.III.10 (22.12.2021) banks requested additional €175, €50, €330, €110, €98 and €52 billion respectively. Early voluntary repayments of some of the TLTRO-III allocations occured first on 29.09.2021 and then subsequently on 22.12.2021. The repayments were equal to €79 and €60 billion respectively. The program called pandemic emergency longer-term refinancing operation (PELTRO) was announced on 30.04.2020 and offered refinancing at -0.25% on a monthly basis. In December 2020 four additional rounds of PELTRO in 2021 were announced. During September 2021 €23 billion PELTROs were outstanding, but on 29.09.2021 €22 billion were repaid. Currently the outstanding amount is equal to €3.4 billion.

The ECB has announced that “the ECB stands ready to provide additional liquidity, if needed.”

4. Data Sources

The data are compiled from the ECB's website. The allotment data of each refinancing operation can be found here. The repayment data can be found here. Repayment occurs normally on the pre-specified maturity date, but can also occur on additional communicated dates prior to maturity. Both information have to be matched to get the current outstanding amount. Rarely there are also repayments which are not published. These repayments can be inferred from the difference between the allotment and repayments and the exact outstanding amount published here.

5. Outlook

In March 2020 President Lagarde has argued that the ECB stands ready to provide up to €3 trillion in liquidity through refinancing operations. This amount can also be derived from the defined borrowing allowance. The initial borrowing allowance was set to 50%, i.e. the maximum amount of refinancing for each bank amounts to 50% of its loan portfolio (consumer and firm loans, but no housing loans) in February 2019. In December 2020 the borrowing allowance was lifted by 5%. Hence, the ceiling of potential refinancing operations now equals €3.3 trillion. In its June 2022 monetary policy decision the ECB announced: "The Governing Council will continue to monitor bank funding conditions and ensure that the maturing of operations under the third series of targeted longer-term refinancing operations (TLTRO III) does not hamper the smooth transmission of its monetary policy. The Governing Council will also regularly assess how targeted lending operations are contributing to its monetary policy stance. As announced previously, the special conditions applicable under TLTRO III will end on 23 June 2022."